Overview — Annual Appropriations Process

The Constitution vests Congress with the responsibility for authorizing the expenditures of the Federal government. An appropriations act is a law passed by both houses of Congress and signed by the President that provides budget authority for a specific purpose. In appropriations acts, Congress identifies the purposes, periods of time, and amounts for all Federal expenditures. The Executive Branch, which includes the President and Federal agencies, cannot transfer funds from one appropriated category to another without explicit authority or approval from Congress nor can they expend funds that have not been appropriated. The Anti Deficiency Act prohibits obligating or expending funds in advance of or in excess of the appropriation.

Key Financial Management Requirements for Discretionary Grants

The Department expects grantees to administer Department grants in accordance with generally accepted business practices, exercising prudent judgement to maintain proper stewardship of taxpayer dollars. This includes using fiscal control and fund accounting procedures that insure proper disbursement of and accounting for Federal funds. In addition, grantees may use grant funds only for obligations incurred during the funding period.

The Office of Management and Budget's (OMB's) Guidance for Federal Financial Assistance in 2 CFR part 200, as adopted and amended as regulations of the Department in 2 CFR part 3474 (Guidance for Federal Financial Assistance) and the Education Department General Administrative Regulations (EDGAR) in 34 CFR Parts 75, 76, 77, 79, 81, 82, 84, 86, 97, 98, and 99 contain additional requirements for administering discretionary grants made by the Department. The most recent version of these regulations may be accessed at:

For additional information on the updates to the OMB Guidance for Federal Financial Assistance please see the Department's FAQs issued in July 2024.

The Department urges grantees to read the full text of these and other topics in EDGAR and in the Guidance for Federal Financial Assistance. Grantees are reminded that a particular grant might be subject to additional requirements of the authorizing statute for the program that awarded the grant and/or any regulations issued by the program office. Grantees should become familiar with those requirements as well, because program-specific requirements might differ from those in the OMB Guidance for Federal Financial Assistance and EDGAR.

The Department recommends that the project director and the fiscal management staff of a grantee organization communicate frequently with each other about the grant budget. Doing so will help to assure that you use Federal funds only for those expenditures associated with activities that conform to the goals and objectives approved for the project.

The cost principles are regulations established by OMB for generally accepted accounting rules used to determine whether costs applicable to grants, contracts and other agreements are allowable, reasonable, and allocable. The Federal cost principles are found in 2 CFR part 200 subpart E. Federal cost principles help recipients and subrecipients determine eligible costs for specific activities identified in grant agreements and contracts and outlines financial management requirements, including audits.

The CLSD program office scrutinizes your project's budget and budget narrative on an annual basis. All direct costs chargeable to a grant must be allowable, reasonable, and specifically allocable to the grant activities and not otherwise recoverable as a reimbursement through the negotiated indirect cost rate.

Further information on the cost principles can be found in 2 CFR 200.403, 200.404, and 200.405).

Financial Management Systems (CFR 200.302)

In general, grantees are required to have financial management systems that:

- provide for accurate, current, and complete disclosure of results regarding the use of funds under grant projects;

- provide adequate source documentation for Federal and non-Federal funds used under grant projects;

- contain procedures to determine the allowability, allocability, and reasonableness of obligations and expenditures made by the grantee; and

- enable the grantee to maintain effective internal control and fund accountability procedures, e.g., requiring separation of functions so that the person who makes obligations for the grantee is not the same person who signs the checks to disburse the funds for those obligations.

State systems must account for funds in accordance with State laws and procedures that apply to the expenditure of and the accounting for a State's own funds. A State's procedures, as well as those of its subrecipients and cost-type contractors, must be sufficient to permit the preparation of reports that may be required under the award as well as provide the tracing of expenditures to a level adequate to establish that award funds have not been used in violation of any applicable statutory restrictions or prohibitions.

The Department pays grantees in advance of their expenditures if the grantee demonstrates a willingness and ability to minimize the time between the transfer of funds to the grantee and the disbursement of the funds by the grantee. Grantees must repay to the Federal government interest earned on advances and, generally, must maintain advance payments of Federal awards in interest-bearing accounts.

Grantees should make payment requests frequently, only for small amounts sufficient to meet the cash needs of the immediate future. The Department has recently encountered situations where grantees failed to request funds until long after the grantee actually expended its own funds for the costs of its grant. Grantees need to be aware that, by law, Federal funds are available for grantees to draw down for only a limited period of time, after which the funds revert to the U.S. Treasury. In some cases, grantees request funds too late for the Department to be able to pay the grantees for legitimate costs incurred during their project periods.

The Department urges financial managers to regularly monitor requests for payment under their grants to assure that Federal funds are drawn from the Department G5 Payment System at the time those funds are needed for payments to vendors and employees.

The rules governing personnel costs are located in EDGAR Part 75 and 2 CFR Part 200 Subparts D and E. Part 75 covers issues such as prohibiting dual compensation of staff and waiving the requirement for a full-time project director. The rules clarifying changes in key project staff are located in 2 CFR 200.308 (f)(2). General rules governing reimbursement of salaries and compensation for staff working on grant projects are addressed in the cost principles in 2 CFR 200 Subpart D and E. In all cases, payments of any type to personnel must be supported by complete and accurate records of employee time and effort. For those employees that work on multiple functions or separately funded programs or projects, the grantee must also maintain time distribution records to support the allocation of employee salaries among each function and separately funded program or project.

Procurement Standards (CFR 200.317-200.327)

Under 2 CFR 200.317 through 2 CFR 200.327, States are required to follow the procurement rules they have established for purchases funded by non-Federal sources. When procuring goods and services for a grant's purposes, all other grantees may follow their own procurement procedures, but only to the extent that those procedures meet the minimum requirements for procurement specified in the regulations. These requirements include written competition procedures and codes of conduct for grantee staff, as well as requirements for cost and price analysis, record-keeping and contractor compliance with certain Federal laws and regulations. These regulations also require grantees to include certain conditions in contracts and subcontracts, as mandated by the regulations and statutes.

Funding Definitions and Periods of Funding

This section provides pertinent background information that explains the Department's established system of budget periods and project periods (established in accordance with the Education Department General Administrative Regulations (EDGAR) 75.250 and 75.251) through which the Department divides funding of multi-year grants.

Project Periods

A project period, also referred to as the period of performance, encompasses the entire period during which obligations may be incurred against an award. Under EDGAR 75.250, the Department can fund a project for up to 60 months unless a program statute or regulation provides for a longer project period. A project period can also be less than 60 months and may even be less than one year.

Budget Periods

When the Department funds grants with project periods longer than one year, it generally funds the grants in annual increments called budget periods. For CLSD grantees, a single budget period is 12 months (see EDGAR 75.251), and funding for each budget period comes from separate fiscal year appropriations.

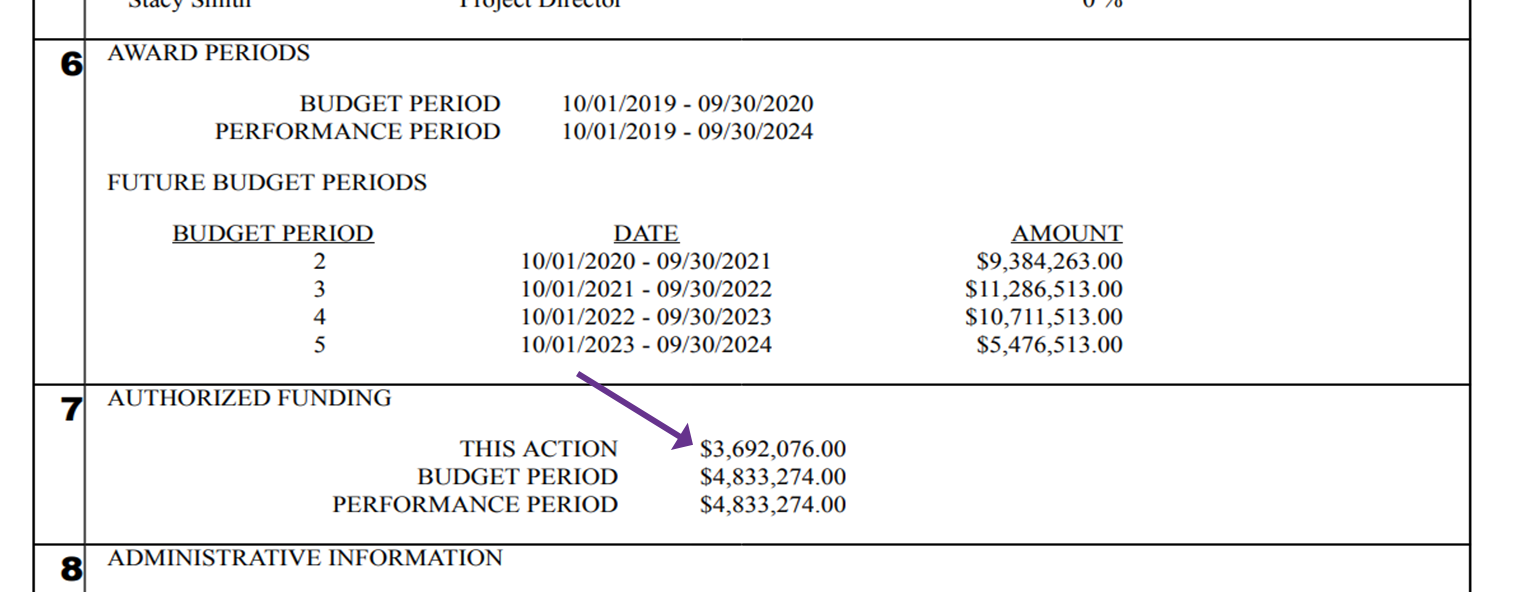

Frontloading

A term that commonly describes the use of appropriated funds available for obligation in a particular fiscal year to fund, in whole or in part, future budget periods of the award. The purpose of frontloading is to obligate funds that would otherwise expire at the end of the fiscal year and revert to the U.S. Treasury. Frontloading can be applicable any year where the amount of funds available for obligation exceed the total planned obligations for the program. For example, if a program receives $25 million in FY 2025, and the total planned obligations for that fiscal year are $18 million, the program office may consider frontloading the remaining $7 million. When this occurs, grantees will receive a separate Grant Award Notification (GAN) once the action is processed in G5. Block 7 in the GAN will include the amount of frontloaded funds next to "this action". In the screenshot below, the arrow indicates the amount of frontloaded funds.

In addition, Block 10 in the GAN will typically include the following language as a specific condition: The United States Department of Education is frontloading a portion of the recommended Year 4 [future budget period] continuation funds for this grant. The grantee may not drawdown the frontloaded funds until the start of Year 4 [future budget period].

As a matter of policy, the Department will avoid frontloading whenever possible, as it is the goal to maximize the number of new awards to promote innovation in education. However, there are times when circumstances exist in which frontloading may be appropriate, or even unavoidable, to avoid a lapse in funds.

Supplement not Supplant

The information below is intended to provide general assistance to CLSD grantees. Any specific questions related to supplement, not, supplant should be directed to your program officer.

Grantees and subgrantees must use CLSD funds to supplement, and not supplant, non–Federal funds that would otherwise be used for activities authorized under the CLSD program (Section 2301 of the ESEA).

Purpose of Supplement not Supplant

The purpose of a supplement, not supplant provision is to help ensure that Federal grant funds are expended to benefit the intended population defined in the authorizing statute, rather than being diverted to cover expenses that the grantee or subgrantee would have paid out with other (nonfederal) funds in the event the Federal funds were not available. In this way, the Federal government can ensure that the level of nonfederal support for a program remains at least constant rather than decreasing due to the addition of Federal funds.

"Supplement, not supplant" requires that grantees use nonfederal funds for all services required by state or local law. Additionally, grantees must not use Federal funds to cover costs that it previously covered with nonfederal funds. Federal funds must supplement—add to, enhance, expand, increase, extend—the programs and services offered with nonfederal funds. Federal funds are not permitted to be used to supplant—take the place of, replace—the nonfederal funds used to offer those programs and services.

If Federal funds are used to enhance or expand an underlying activity that is paid for with nonfederal funds, then the Federal supplementary activities must be separately identified and clearly distinguishable as an addition to what's required under State or local law, or as compared to what has been paid for in the past with nonfederal funds.

Presumptions of Supplanting

Below are two scenarios in which the U.S. Department of Education presumes that supplanting has occurred. In these cases, once the presumption of supplanting has been made, it is the grantee's responsibility to rebut the presumption.

Whether the activity is required by law:

Using CLSD funds for an otherwise allowable CLSD activity that is required by State or local law raises a presumption of supplanting because one presumes that an SEA and LEA will comply with the State's legal requirement with its own funds, even in the absence of Federal funds.

If the activity was provided in prior years with non-Federal funds:

Using CLSD funds for an activity otherwise allowable under the CLSD program that an SEA provided in prior years with non-Federal funds also raises a presumption of supplanting because, in the absence of CLSD funds, an SEA's prior decisions to use non-Federal funds for the activity is a reliable predictor that the SEA would continue to pay for those activities with non-Federal funds in the current year. However, this presumption can be rebutted if an SEA can demonstrate with contemporaneous evidence that it would not have continued to provide the same activities with non-Federal funds, perhaps because of circumstances such as a serious budget shortfall or reduction or changed educational priorities.

Indirect Costs — General

Indirect costs are incurred by a grantee for common objectives that cannot be readily and specifically identified with your grant project. Examples include salaries of personnel who process payroll as these costs are necessary to manage a Federal grant. To charge indirect costs to a grant, a grantee must have a current indirect cost rate agreement that is negotiated with and approved by the grantee's cognizant agency, (i.e., the Federal department or agency providing the grantee with the most direct Federal funding subject to indirect cost support, or an agency that is otherwise designated by OMB). If an entity receives most of its Federal funding indirectly as a sub-recipient via another entity (for example, a State educational agency [SEA]), the organization that provides the pass-through Federal funding is responsible for establishing an indirect cost rate for the subrecipient. A grantee that is charging indirect costs to a grant cannot categorize an activity as a direct cost if that activity is identified as an indirect cost in the grantee's indirect cost rate agreement.

Because the CLSD program is subject to the supplement-not-supplant provision, CLSD grantees are required to use their restricted indirect cost rate. Grantees may only recover indirect costs at the restricted rate included on their negotiated indirect cost rate agreement. Restricted rates for SEAs are included on the SEA's negotiated indirect cost rate agreement.

Indirect costs are charged to the grant as a percentage of the direct costs or the Modified Total Direct Costs (MTDC). The MTDC consist of all direct salaries and wages, applicable fringe benefits, supplies, and travel, plus each subaward and contract up to the first $25,000. The chart below provides an example of how to determine MTDC for a project in order to correctly apply the indirect cost rate and calculate indirect costs.

Course Description: This 45-minute course provides an overview of indirect costs. It will include how to define indirect, direct, and direct administrative costs and how to apply the Regulatory and Statutory Framework of these costs.

Course Objective: After completing this course, you will be able to: define indirect costs, direct costs, and direct administrative costs; apply the regulatory and statutory framework of these costs; define an indirect cost rate (ICR); identify factors affecting allowability of costs; determine the types of distribution bases; calculate and apply an indirect cost rate; understand the responsibilities of a grantee and cognizant agency when obtaining an indirect cost rate; and identify the types of indirect cost rates.

For more information please visit the ED Indirect Cost Guidance website for all things indirect costs.

The Lifecycle of Grant Funds

There are three distinct phases in the lifecycle of grant funds: obligations, expenditures, and drawdowns.

Obligations — a binding agreement that will result in outlays of funding, immediately or in the future.

When Funds are Obligated

When obligations are made. The following table provides guidance on when obligations are made for various kinds of property and services as defined in EDGAR § 75.707.

| If the obligation is for— |

The obligation is made— |

| (a) Acquisition of real or personal property |

On the date the grantee makes a binding written commitment to acquire the property. |

| (b) Personal services by an employee of the grantee When the services are performed. |

When the services are performed. |

| (c) Personnel services by a contractor who is not an employee of the grantee |

On the date on which the grantee makes a binding written commitment to obtain the services. |

| (d) Performance of work other than personal services |

On the date on which the grantee makes a binding written commitment to obtain the work. |

| (e) Public utility services |

When the grantee receives the services. |

| (f) Travel |

When the travel is taken. |

| (g) Rental of real or personal property |

When the grantee uses the property. |

| (h) A pre-agreement cost that was properly approved by the Secretary under the cost principles in CFR 200, Subpart E—Cost Principles |

On the first day of the project. |

Expenditures — an expenditure is a payment or disbursement of funds.

Drawdowns — the process of a grantee's finance office submitting documentation to the Department's G5 for reimbursement of expended funds.

Excel Budget Tool

The OMB-approved budget tool was created in response to feedback from grantees who had difficulty completing their budgets in a Word document. The tool allows a grantee to track its budget over the life of the grant. An additional benefit of the tool is that it maintains all grantee budget data, including any revisions, in one file.

Grantees will use the budget tool at least four times in a fiscal year. The guidance and subsequent submissions will be part of the reporting process (see additional information below).

There are five types of budget templates in the budget tool:

- the original application budget – grantees will enter budget data for all five years of the project (this is completed one time);

- annual budget/revisions – grantees will enter budget data for a single year and track all budget revisions during the year (will be updated annually);

- expenditure updates – grantees will enter funds that have been spent for each quarter during the year (Q1: October – December, Q2: January – March, Q3: April – June, Q4: July – September);

- annual projected carryover — grantees will project the amount of unexpended funds for the current budget period as of the last day of the performance period (see EDGAR 75.253) (will be updated annually); and

- the annual revised budget – grantees will calculate the actual amount of unexpended funds from the previous performance period and reallocate those funds for the current performance period (will be updated annually).

Project Budget (Application)

The original application budget — grantees will enter budget data for all five years of the project (this is completed one time).

Annual Budget and Revisions

Annual budget/revisions — grantees will enter budget data for a single year and track all budget revisions during the year (will be updated annually).

Annual Expenditures

Quarterly expenditure updates — grantees will enter funds that have been spent for each quarter during the year (Q1: October — December, Q2: January — March, Q3: April — June, Q4: July — September).

Annual Projected Carryover

Annual projected carryover — grantees will project the amount of unexpended funds for the current budget period as of the last day of the performance period (see EDGAR 75.253) (will be updated annually).

Annual Revised Budget

Annual revised budget — grantees will calculate the actual amount of unexpended funds from the previous performance period and reallocate those funds for the current performance period (will be updated annually).

Resources — Guidance

Resources — Grants Management Training

This course is under maintenance due to updates to 2 CFR Part 200. Please review the disclaimer to identify key regulatory reviews before taking the course.

Course Description: This 60-minute course provides Department grantees and subgrantees a high-level overview of the concepts and regulations behind using Federal grant funds for allowable costs and activities. Divided into two modules, the course addresses the objectives presented below. At the end of each module, participants are asked questions that will gauge their understanding of the covered topics, but no score or grade will be given.

Course Objective:

After completing this course, you should be able to:

- Identify key laws and regulations that guide the use of Federal funds for grant costs and activities

- Understand how Grant Award Notifications, grant applications, and State plans impact allowable and unallowable costs

- Define the concepts of allowable costs and activities

- Describe the importance and benefit of allowable costs and activities concepts in grant management

- Compare and contrast direct versus indirect costs

- Determine whether a cost is allowable or unallowable

- Explain how to protect against making unallowable costs

- Explain how to protect against making unallowable costs

- Understand the consequences of incurring unallowable costs

This course is under maintenance due to updates to 2 CFR Part 200. Please review the disclaimer to identify key regulatory reviews before taking the course.

Course Description: This 45-minute course provides an overview of indirect costs. It includes how to define indirect, direct, and direct administrative costs and how to apply the Regulatory and Statutory Framework of these costs.

Course Objective:

After completing this course, you will be able to:

- Define indirect costs, direct costs, and direct administrative costs.

- Apply the regulatory and statutory framework of these costs.

- Define an indirect cost rate.

- Identify factors affecting allowability of costs.

- Determine the types of distribution bases.

- Calculate and apply an indirect cost rate.

- Understand the responsibilities of a grantee and cognizant agency when obtaining an indirect cost rate.

- Identify the types of indirect cost rates.

This course is under maintenance due to updates to 2 CFR Part 200. Please review the disclaimer to identify key regulatory reviews before taking the course.

Course Description: This 45-minute course provides an overview of cash management guidelines, regulations and requirements on grant draw-downs and accrued interest, and consequences for non-compliance. An interactive exercise is included to engage the learner in the decisions required of a grant recipient related to cash management procedures.

Course Objective:

At the end of this course, learners will be able to:

- Identify and apply the cash management regulations for payments.

- Identify the legislation applicable to different types of grantees.

- Apply the requirements of minimizing the time between the drawdown of federal funds and the disbursement of those funds for grant activities.

- Apply, depending on the grantee type, the requirements for remitting earned interest.

This course is under maintenance due to updates to 2 CFR Part 200. Please review the disclaimer to identify key regulatory reviews before taking the course.

Course Description: This 40-minute course provides an overview of internal controls and explains what they are and why they are important. It also provides information about the categories of objectives, regulatory requirements and guidance to develop internal control systems, the components and principles of internal controls and the interrelationship between them.

Course Objective:

After completing this course, you will be able to:

- Define internal controls and their purpose.

- Define the categories of objectives (i.e., operations, reporting, and compliance) and understand how internal controls are applicable to all aspects of a grantee's or a grantee's parent organization's objectives.

- Locate and access internal control regulatory requirements and guidance.

- Understand the applicability of the "Standards for Internal Control in the Federal Government" publication (i.e., the Green Book) and the "Internal Controls - Integrated Framework" publication to develop internal control systems.

- Define the five components and seventeen related principles of internal controls.

- Understand the interrelationship between the categories of objectives, the five components of internal controls and an organization's structure.

This course is under maintenance due to updates to 2 CFR Part 200. Please review the disclaimer to identify key regulatory reviews before taking the course.

Course Description: This 45-minute course is intended to provide an introduction to the Federal Funding Accountability and Transparency Act, or FFATA. It is divided into two modules; Overview of FFATA Requirements and Navigating FSRS.gov Overcoming Common Reporting Challenges.

Course Objective:

After completing this course, you will be able to:

- Identify which grantees must report under Federal Funding Accountability and Transparency Act (FFATA)

- List the reporting requirements including the timeline for when to report

- Access USAspending.gov and FSRS.gov

- Identify and avoid FFATA reporting challenges

- Locate key on-line resources